Maximizing Your Fix-and-Flip Prosperity: A In-Depth Manual For Selecting The Ideal Contractor

Effective relationships with contractors play a pivotal role in the success of fix-and-flip investments. Contractors oversee project management and enlist specialized subcontractors, making their selection crucial. In this article, we delve into the strategies for finding the ideal contractor tailored to your unique fix-and-flip project requirements.

Why a Reliable Contractor can "make it or break it" for Your real estate Project?

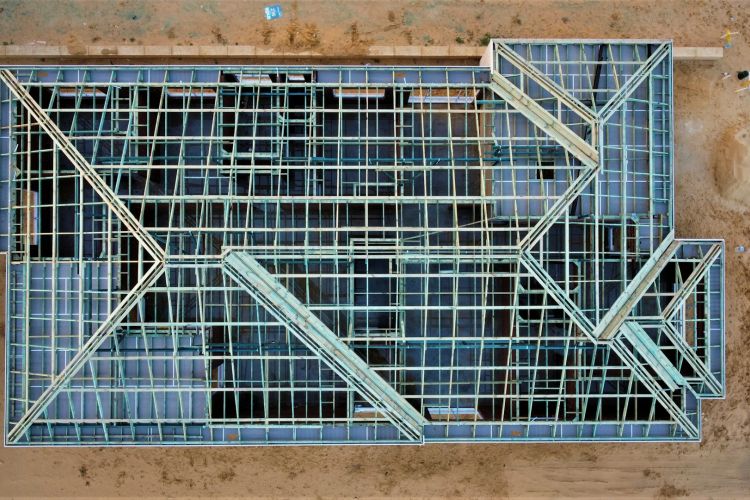

Real estate investors undertaking significant renovations, often managing multiple projects simultaneously, must prioritize hiring a licensed contractor. The repercussions of selecting the wrong person include project delays, quality issues, budget overruns, safety concerns, and legal complications. Given the time-sensitive nature of fix-and-flip projects, hiring a contractor with a solid well "tooled" reputation, effective communication, and relevant experience is paramount.

Understanding Your Project Needs

Before engaging a contractor, a thorough understanding of your project's scope is essential. Consider factors such as property type, size, condition, long-term goals, budget, and timeline. Define specific goals for design elements, target market, and layout. This clarity aids effective communication with potential contractors, influencing project quotes and ensuring compatibility with the contractor's skills.

Qualities to Seek in a Contractor

Beyond technical skills, identifying certain qualities in a fix-and-flip contractor is crucial. Look for demonstrated experience in similar projects, understanding of local market dynamics, proper licensing, positive reviews, transparent communication, punctuality, creative problem-solving skills, and a commitment to high-quality craftsmanship. Clear and fair contract terms regarding payment schedules and pricing are also key considerations.

Finding the Right Contractor

Discovering the right contractor involves a strategic approach:

Ask for Recommendations: Seek referrals from friends, family, mortgage brokers, and real estate professionals. Recommendations offer insights into a contractor's work quality, adherence to budgets, and respect for timelines.

Do your own due diligence: Explore platforms like Thumbtack, Angi, HomeAdvisor, Yelp, and Facebook Marketplace. Conducting a "contractors near me" search on Google can also reveal businesses with reviews from multiple clients. Look up there liscense status with the state of California. Take a look at their E and O Insurance.

Interview Prospective Contractors: Conduct a thorough interview process, including portfolio review, phone calls, in-person meetings, and obtaining bids. Evaluate communication ease, punctuality, and overall enthusiasm for your project. Walk their past projects.

Clarify Project Scope: Provide a detailed project scope during walk-throughs with contractor prospects. Request written bids for accurate pricing comparisons.

Establish a Communication Plan: Clearly define communication parameters and project check-ins to ensure progress alignment and prevent scope creep.

Perform a Final Walk Through of your project : Schedule a final walkthrough post-completion to assess the finished product and evaluate the contractor's responsiveness to queries or requests.

For more information on our Hard Money Loans or Trust Deed Investments, call our office at 714.838.1474 or visit our:www.hanovermc.com